What is the Canadian Small Business Limit?

Small Business Limit is the cutoff of annual income that constitutes a business as a small business for the small business tax rate.

In Canada, Canadian-controlled private corporations (CCPCs) pay corporate income tax on small business income at 9% federally and 2% provincially for BC, for a combined small business tax rate of 11% (2019). The small business limit is $500,000 federally annually. The small business rate accounts for all Associated Corporations as well, which is explained below.

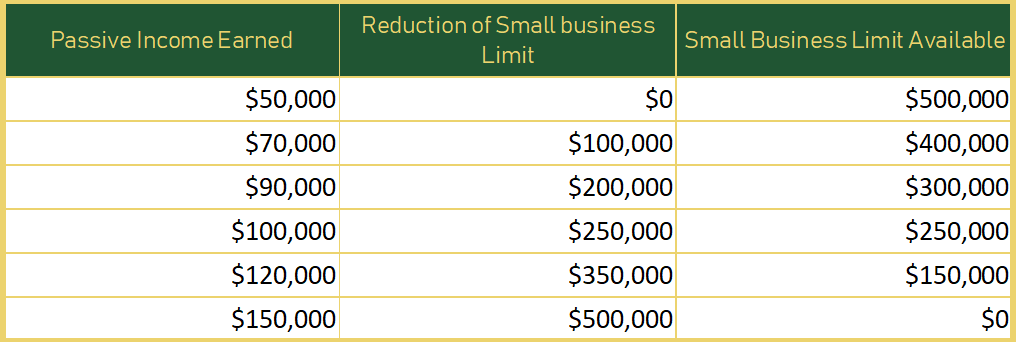

Since 2018, the small business limit is reduced by $5 for every $1 of investment income above a $50,000 threshold. With this formula, the small business deductions will be eliminated when investment income (passive income) reaches $150,000 in a given taxation year.

This chart shows how the limit reduction works:

This targets the small business limit rather than changing the taxation method of passive income. Thus, investments in a corporation that do not have small business income, such as investment holding companies (with no relation to corporations claiming small business deductions), will not be affected by this rule.

Adjusted Aggregate Investment Income (AAII), or commonly known as invested income/passive income, includes these types of investment income:

- Interest

- Taxable capital gains in excess of allowable capital losses of the current taxation year from the disposition of passive investments

- Rents

- Royalties

- Portfolio dividends

- Dividends from foreign corporations that are not foreign affiliates

This specifically excludes gains or losses from the disposition of active assets (assets used for the operation of your business).

Dividends received from connected corporations will be excluded as AAII and will be counted as business income. In addition, if the process of earning income from a property is sufficient, it will be excluded from AAII on the basis that it is income from active businesses and not an investment income.

Example: If 5 employees were engaged in earning rental income, that rental income would be active business income and would not be categorized as AAII.

Associated Corporations

Associated corporations must share the small business limit. An example of an associated corporations would be a parent company and its operating company. Investment income within the associated corporations must be aggregated to determine if the $50,000 threshold has been surpassed and to determine the amount of the small business har will be clawed back. The post-aggregated small business limit is then what must be shared within an associated group of companies.

How to minimize the impact

1. Reducing the investment income to reduce the rule’s impact

- Consider what expenses are incurred or could be incurred to reduce the AAII within the CCPC

- Avoid earning investment income within the CCPC

2. Minimizing the impact of the rule when it is evident they will apply

- You may choose to realize your gains in a year where you have exceeded the maximum $150,000 investment income as there are no extra tax costs for earning more than the $150,000 cap. Rather than a year where the total of other investment income is less than the maximum.

- Or you could realize the investment gains in a year where your business income is low as to not exceed the small business limit